Fiverr’s $10 Billion Collapse: When Replacing Humans Goes Wrong

Fiverr reached dizzying heights during the pandemic, only to come crashing down by $10 billion. This article takes a deep dive into the missteps that led to its downfall, from overhyped growth to AI-driven decisions that didn’t quite hit the mark.

Fiverr was once a shining star in the gig economy, boasting a $11 billion valuation. But after a series of questionable decisions, that same star fell from the sky. The pandemic initially gave Fiverr a massive boost, but the company couldn’t sustain that growth. Misguided spending, platform tweaks that backfired, and a heavy push into AI created a perfect storm. In less than two years, Fiverr lost over 90% of its value. Let’s unpack what went wrong and what it all means for the future of freelance platforms.

The Golden Age: Humans Actually Talking to Humans (Seriously!)

Back in the day (think early 2010s), Fiverr felt like stumbling into a bustling global bazaar for digital skills. Need a logo? A jingle? Some code fixed? Someone, somewhere, would do it for five dollars. Simple. Revolutionary, even.

- The Magic Was in the Mess:

- Discovery Was an Adventure: You didn’t just type “logo.” You browsed. You scrolled through profiles packed with personality – quirky designers, earnest writers, programmers with niche specialties. Portfolios screamed individuality. You chose someone based on their vibe, their style. It felt personal.

- Conversation Was Key: That little chat box? It was everything. “Hey, love your stuff, but can you make the owl look less… menacing?” “Sure! Maybe give him glasses?” This back-and-forth built trust, clarified fuzzy ideas, turned a $5 gig into a $50 project. Humans figuring it out, together.

- Reputation Was Earned, Not Gamed: Seller levels (Newbie, Level 2, Top Dog) weren’t just badges. They meant something. They reflected sweat, late nights, and consistently making buyers happy. Reviews weren’t just stars; they told stories. Success felt earned, human-scale.

- Real People, Real Opportunity: For countless folks worldwide – designers in Jakarta, writers in Nairobi, coders in Buenos Aires – Fiverr wasn’t just an app. It was a lifeline, a passport to a global market. Genuine micro-entrepreneurship sparked.

- Proof in the Pudding (The Numbers Don’t Lie):

- People Flocked In: Millions of buyers, millions of sellers. A genuine phenomenon by its 2019 IPO.

- Five Bucks Became Fifty (Sometimes): The average order value climbed steadily. Why? Because humans negotiated, upsold, built relationships beyond the initial offer. Complexity thrived.

- Fiverr Got Paid (Well): Their commission (take rate) was healthy and growing. People saw value in the platform.

- Wall Street Bought the Hype (Literally): IPO at $21? Cool. Then, pandemic-fueled demand rocketed the stock to a dizzying $336 per share by Feb 2021. Market cap? A cool $10+ Billion. Life was good. Very good.

The Pandemic Boost

When the world went into lockdown, Fiverr found itself in a unique position. Businesses needed help, and fast—yet, they didn’t want to commit to hiring full-time employees. Enter Fiverr. The timing was perfect:

- Digital Transformation: Companies quickly shifted online, driving demand for everything from digital marketing to e-commerce.

- The Freelance Explosion: Layoffs and furloughs turned many to freelancing. Fiverr offered an accessible platform for freelancers to thrive.

- Outsourcing Over Hiring: Businesses, wary of the financial uncertainty, found freelancing to be a more affordable and flexible alternative.

Suddenly, Fiverr was in the right place at the right time, and it showed in the numbers. Revenue soared from $189 million in 2020 to $300 million by 2021. Its stock price shot up from $25 to over $200. At one point, Fiverr was worth more than $11 billion. It looked like they could do no wrong. But then…

The Crash

Financial Woes and Over-Spending

It wasn’t the revenue growth that doomed Fiverr; it was the way they spent the money. For a company that was still operating at a loss, it seemed as though every penny was going to flashy marketing campaigns, acquisitions, and R&D. They even splurged on a Super Bowl ad. Bold? Yes. Wise? Not so much.

- Unrealistic Growth Strategy: Fiverr was all about expansion—at any cost. Yet, they never figured out how to turn those millions into real profit.

- Unstable Finances: Despite the surge in sales, Fiverr lost $33 million in 2019, $14 million in 2020, and a whopping $70 million in 2022.

Even with all the hype, their books didn’t add up.

Strategic Missteps: Fiverr’s Big Mistakes

Changing the Platform

In an attempt to cater to newer freelancers, Fiverr tweaked its platform to prioritize fresh faces. The idea was simple: more sellers, more competition, and more variety. The problem? They pushed aside established, high-performing freelancers in the process. Top earners found their rankings plummeting, causing frustration and loss of income. A change that was meant to help ended up costing the company loyal users.

Hidden Fees: A Breach of Trust

Then there was the issue with hidden fees. Fiverr introduced extra charges at checkout, but didn’t exactly make them easy to find. Naturally, clients weren’t thrilled about paying more than expected. Freelancers weren’t any happier. What was supposed to be a straightforward platform suddenly seemed a little… sketchy.

Marketing Gone Wrong

Marketing is hard, but Fiverr made it even harder with a few tone-deaf campaigns. There was the infamous ad from 2017 that glorified burnout. It wasn’t just bad marketing; it sent the message that hustling to the point of exhaustion was a badge of honor. Fast-forward to 2023, and Fiverr’s attempt to promote AI-based services backfired too. Freelancers didn’t take kindly to the suggestion that they might soon be replaced by algorithms.

The AI Push: Replacing Humans (or Not?)

Fiverr had big plans for AI. The company jumped on the trend of offering AI-powered tools to help freelancers generate content quickly. While this opened new doors for some, it also sparked fear among many of Fiverr’s core users: the freelancers themselves.

They saw it as a potential threat, a signal that their jobs were in jeopardy. After all, AI could automate the very tasks they were doing for clients. Fiverr’s CEO even sent out a leaked email acknowledging that “AI is coming for your jobs”—a statement that only fueled the fire.

In an effort to adapt, Fiverr laid off 250 employees (about 30% of its workforce) in September 2025. The company, once a champion of human talent, was now transitioning to an “AI-first” model. Fiverr’s future had become an uncertain balancing act between technology and human creativity.

Key Stats: Fiverr’s Rollercoaster

| Metric | Value |

|---|---|

| Peak Stock Price | $248 per share |

| Current Stock Price | $25 per share |

| Revenue (2021) | $300 million |

| Loss (2022) | $70 million |

| Layoffs (2025) | 250 employees (30% of workforce) |

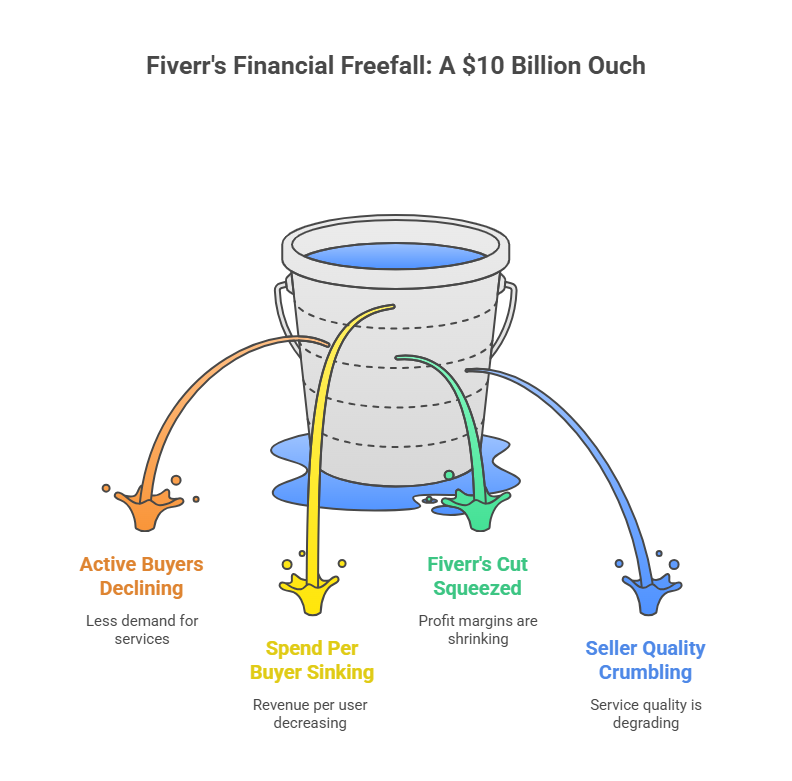

The $10 Billion Ouch (Let’s Talk Numbers)

Investors aren’t sentimental. They saw the user experience implode and voted with their wallets. Brutally.

| Fiverr’s Financial Freefall: The Hard Truth | Peak High (Feb 2021) | Current Reality (~Oct 2024) | The Damage |

|---|---|---|---|

| Stock Price (FVRR) | ~$336 | ~$25 | -92.5% |

| Market Value | >$10 Billion | ~$1 Billion | -90% |

| Active Buyers (Trend) | Surging | Flatlining/Declining | Bad |

| Spend Per Buyer (Trend) | Rising Steadily | Stuck or Sinking | Worse |

| Fiverr’s Cut (%) | Solid & Growing | Squeezed & Challenged | Tense |

| Seller Quality/Retention | Strong Foundation | Crumbling Fast | Dire |

| Overall Buzz | Golden Child | Radioactive | Yikes |

- Stock Plunge: That $336 peak? Ancient history. A relentless descent brought it down to earth, currently hovering around $25. That’s a 90% haircut. Ouch doesn’t cover it.

- Value Vaporized: Over $9 Billion in shareholder wealth? Gone. Poof. A staggering monument to strategic failure.

- Growth? What Growth?: Sure, Fiverr might report a tiny buyer increase sometimes. But the value of those buyers? The quality of the interactions? The retention? All pointing south. Growth fueled by cheap, algorithmically-forced matches isn’t sustainable growth. It’s a sugar rush followed by a crash.

The Takeaways: Lessons from Fiverr’s Fall

Fiverr’s story offers several important lessons that both investors and freelancers should heed:

- Growth Doesn’t Equal Success: It’s easy to get caught up in growth numbers, but without a clear path to profitability, the climb can only last so long.

- Be Mindful of Your Core Users: Pushing for new users is great, but not at the expense of the ones who helped build your platform.

- Don’t Alienate Your Workforce: When your business relies on freelancers, it’s a bad idea to position yourself as the enemy by promoting tools that threaten their livelihood.

- Be Transparent: Hidden fees and murky policies are a surefire way to lose trust with both your clients and your users.

Conclusion: A Changing Gig Economy

Fiverr’s journey from a pandemic darling to a cautionary tale is a reminder that the gig economy is anything but predictable. Platforms like Fiverr play a crucial role in helping freelancers find work, but as Fiverr’s downfall shows, there’s no one-size-fits-all approach to growth.

Freelance platforms need to balance innovation with trust and sustainability. For Fiverr, the quest for the next big thing—AI, cost-cutting, and user acquisition—ultimately led to the very thing they feared: their downfall. The gig economy, though full of potential, is constantly evolving. Fiverr’s mistakes will be studied, but they also provide a roadmap for the future of online freelancing platforms.

Frequently Asked Questions (FAQs)

Q1: Why did Fiverr’s stock price fall so drastically?

A1: Fiverr’s over-reliance on rapid, unsustainable growth strategies, controversial platform changes, and a misguided push toward AI services led to a loss of user trust, which heavily impacted their valuation.

Q2: How did Fiverr’s AI push affect freelancers?

A2: Fiverr’s integration of AI tools was seen by many freelancers as a threat to their jobs. The fear of being replaced by AI, combined with the company’s workforce reductions, created anxiety among users.

Q3: What did Fiverr do wrong with its platform changes?

A3: Fiverr prioritized new sellers over top-performing freelancers, leading to frustration and loss of income for established users. This shift backfired and resulted in a decline in user satisfaction.

Q4: Can Fiverr recover from this slump?

A4: While Fiverr has begun to generate positive operating income, its dramatic stock price drop and layoffs suggest that the company still has a long way to go before fully regaining trust and stabilizing.

Fiverr’s tale is one of highs and lows. It’s a classic example of how ambition and innovation must be balanced with empathy and sustainability. In the race for AI dominance, Fiverr forgot one crucial thing: the people who built its empire.